What Is Bitcoin? A Very Basic Introduction for Beginners.

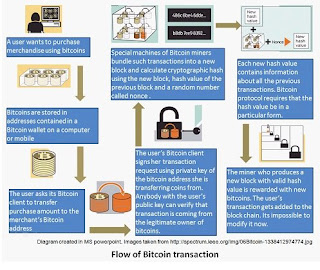

Bitcoin is an advanced cash and electronic installment framework consolidated into a solitary bundle. It utilizes a 'distributed' system, implying that clients can make installments straightforwardly to each other, without the need to experience mediators, for example, banks or charge card organizations. New coins are additionally issued by the system itself, without the requirement for a focal issuing specialist, for example, a bank.

What Is Bitcoin? A Very Basic Introduction for Beginners.

It was imagined in 2008 by some person utilizing the name 'Satoshi Nakamoto', who has since vanished from general society eye and can't be found. The name itself is broadly accepted to be a pen name, a few observers even trust that it was utilized by a gathering of individuals, as opposed to a person.

The money code of Bitcoin is BTC, albeit a few people additionally utilize XBT to take after the traditions laid out by the conventional budgetary administrations industry. A money image of "Ƀ" or "BitcoinSign.svg" is additionally utilized, similarly that images, for example, "$" or "£" are utilized to mean dollars or pounds individually. Each Bitcoin is distinguishable into littler units called 'Satoshis', which are a generally equal to pennies or pennies. In any case, not at all like pennies or pennies notwithstanding, which speak to one hundredth of the principle cash unit, a solitary Satoshi is worth only 1 hundred millionth of a Bitcoin. This takes into account considerably more noteworthy adaptability in the measure of cash that can be sent.

Since there is such a major contrast between a one Satoshi and Ƀ1, different units, for example, the micro-bitcoin (µBTC) or 'Bit', speaking to 1 millionth of a coin, and the milli-bitcoin (mBTC) speaking to 1 thousandth of a coin, are once in a while utilized too.

Recently produced coins are paid to individuals called 'diggers', who run programming that secures and keep up the system. Anybody can turn into a mine-worker basically by running the product on their PC, however furious rivalry implies that making a benefit from it today as a rule requires an interest in expert PC equipment or access to shoddy power rates.

At the point when a client sends coins to some person there is a discretionary 'mine-workers charge', now and again called an 'exchange expense'. In spite of the fact that this is totally discretionary, it ensures that your exchange is handled rapidly and is especially vital if your installment incorporates a great deal of information.

In the end the system will quit making new coins, as there is a hard-coded greatest of 21 million coins, after which no more can be created. Now, which will most likely take a very long while to achieve, mine-workers will gain income from exchange expenses alone.

Because of its broad utilization of cryptography, it is now and again known as the primary 'cryptocurrency'.

Why Buy Bitcoin?

If you don't mind note: while all that you can read in this area stays as valid as when it was composed, another page has been made on our site which gives an (ideally) enhanced adaptation: Why purchase Bitcoin or another computerized money?

In the event that you are investigating the majority of this surprisingly then you may well be contemplating internally: "That is all exceptionally fascinating, yet why would it be advisable for me to purchase Bitcoin?"

There are many motivation behind why you ought to consider purchasing and utilizing Bitcoin:

It's Cheap – Transaction expenses are lower than the proportionate charges forced by installment frameworks, for example, credit and platinum cards, Paypal, bank exchanges, etcetera. For little exchanges which you wouldn't fret taking more time to affirm, you don't need to pay any expenses by any stretch of the imagination! Since retailers are regularly compelled to pay generous charges to acknowledge Mastercards, large portions of the individuals who acknowledge BTC will pass some of that sparing onto clients as rebates.

It's International – International cash exchanges are generally extremely costly, and on the off chance that you experience the managing an account framework they can likewise take days to experience. Bitcoin is the main genuinely worldwide cash of any critical size. Sending cash to some individual on the opposite side of the world with Bitcoin is not any more costly than sending cash to your neighbor, or purchasing something at your nearby shop. Global installments are practically moment and cost a small part of what you would pay in expenses, and lose in cash change, when sending cash through conventional strategies. They can likewise be sent to any piece of the world where there is a web association (or SMS, on the off chance that you utilize an outsider administration).

It's Safer than a Bank (#1) – This may amaze a few perusers, however keeping your cash in Bitcoin is generously more secure than keeping it in a bank, shielding you from two noteworthy dangers. When you put your cash into a financial balance you are assuming that bank to keep your cash safe and to permit you to get to your assets at whatever point you require them. Here and there this trust is lost. Banks can blunder subsidizes and lose your cash, they can get to be distinctly indebted and endure bank runs, and they can keep you from getting to your own particular cash. Since the monetary emergency and worldwide subsidence which started in 2008 (maybe not really fortuitously the year Bitcoin was concocted), we have seen numerous cases of this sort of thing, from the bank levy in Cyprus to coming up short banks requiring tremendous bailouts from citizens. Numerous administrations now offer halfway protection to ensure bank stores, yet this is constantly restricted to a most extreme sum, relies on upon your legislature having the capacity to bear the cost of another round of bailouts if essential, and does not make a difference to individuals in all nations. Since Bitcoin does not oblige you to put stock in your cash to an outsider, no one can lose your assets through botch, debasement, misrepresentation, or dangerous 'gambling club managing an account' hones. It is additionally inconceivable for anyone to constrain you to pay for other individuals' terrible conduct through things like the bank levy or negative loan costs.

It's Safer than a Bank (#2) – Customers of customary money related administrations gave by banks, Mastercard organizations and so forth experience the ill effects of high rates of burglary and misrepresentation. Cards can be cloned, data fraud fraudsters can access your records, and everything from installment terminals to ATMs to paypal records to in-house bank programming are general hacked into by cheats, prompting to the loss of clients' cash. This may likewise astonish a few perusers, yet Bitcoin has never been hacked. One of the greatest myths about BTC is that utilizing it abandons you open to the danger of programmers taking your cash. This myth was conceived out of a progression of prominent assaults against major advanced cash trades in which numerous clients lost their coins. These trades, frequently made by innocent lovers with little experience amid the beginning of the system, gave administrations which included them taking their clients coins and putting away them on focal servers. This voided the natural security points of interest of the distributed system and gave an objective to programmers and fraudsters with insider get to. It was these early and unprofessional administrations and not Bitcoin itself which turned into an objective for programmers. Today, more experienced and expert business people are making trades and online wallet administrations which don't require this sort of incorporated administration, and regardless you can simply pick not to confide in your coins to an outsider by any stretch of the imagination, keeping full control of your own riches yourself…

You hold full control of your cash – notwithstanding potentially losing all or some portion of your cash, banks likewise force limitations on how you utilize it. This can appear as breaking points on the amount you are permitted to pull back from your record every day, where you are permitted to spend your cash (Visa suppliers broadly united with Paypal to deny financing to WikiLeaks, for instance, while things like betting and suggestive sites are routinely blocked), and authorizing capital controls on how much cash you are permitted to exchange out of the nation. No one has specialist over records made on a shared system other than their proprietors, so no one can reveal to you how and where to utilize your own particular cash.

Less Fraud and Misuse – When you set up an immediate charge from your financial balance you are viably giving some individual authorization to take your cash, and assuming that they will just take the sum they are properly owed. There are numerous cases in which this doesn't occur, from basic slip-ups getting out individuals' present record and abandoning them with nothing to try and purchase sustenance, to savage credit organizations taking concealed expenses and charges from the records of defenseless clients. In like manner, retailers have a gigantic issue with charge-back extortion, in which a fraudster makes an installment, gets the item, and afterward paws back the cash they spent – adequately taking the item from the retailer. With Bitcoin you realize that the coins you have in your wallet are yours, and no one can utilize such semi-legitimate strategies to take from you.

Improved Financial Privacy – Contrary to its famous picture, Bitcoin is not mysterious. All exchanges are recorded on an open blockchain which anyone can see, in any case it is conceivable to make an "account" without expecting to give anybody character reports. This not just implies that it is substantially faster and less demanding to begin utilizing Bitcoin, or to make another wallet account, than it is to get another ledger or card, it additionally implies that clients can appreciate a more noteworthy level of money related security. Today we live in reality as we know it where individual data is an important ware which can regularly be utilized against you by the general population who have admittance to it, affecting the administrations you access and being utilized by advertisers to control you. The capacity to lead your funds in private implies that you can put your psyche very still that your own information won't be followed, sold on to different organizations, or utilized against you later on.

Improved Transparency – It might appear like an inconsistency to list both protection and straightforwardness as reasons why you ought to purchase Bitcoin, yet in the event that you do uncover the association be between your open locations and your own character then your full money related history will be available by anyone without them expecting to persuade an outsider to pass on important information. This implies you have full control of your very own data, to be as private or as straightforward as you be. It likewise implies that organizations and open associations can offer definitely enhanced levels of straightforwardness and responsibility.

Cash Creation Without Usury – The initial eight focuses in this 'why purchase bitcoin?' segment are all down-to-earth contemplation identifying with you as a person. Be that as it may, there are likewise more extensive good, social, and monetary reasons which are vital to consider. Many individuals don't understand that most present day cash is just made when some person gets it into reality. This can be on the grounds that a national bank loans cash to different banks or to government, or on the grounds that a private business bank needs to make cash out of nowhere keeping in mind the end goal to loan it to one of their clients. This implies some individual owes enthusiasm on each dollar, euro, pound (or whatever) in your pocket. Aside from the way that it is risky and unreasonable to permit business elements to control a nation's cash creation for their own benefit, this makes an economy inherently in light of obligation, which requires ever more prominent levels of obligation keeping in mind the end goal to develop (see: national obligation can never be reimbursed) and is energizing an unsustainable worldwide obligation bubble. If everyone somehow happened to pay off the majority of their obligations, there would actually be no cash. This implies individuals are not allowed to pick not to acquire cash at premium – in the event that they attempted to settle on this decision then the cash supply would begin to go away and the individuals who require cash the most would dependably be compelled to begin obtaining and paying premium once more. This is called 'usury'. As indicated by real world religions, for example, Christianity and Islam, usury is exceedingly unethical. In any case, our entire fiscal framework is unequipped for working without usury. New advanced monetary standards, for example, Bitcoin give an option framework fit for issuing new cash without usury.

Begin With Bitcoin

All you have to begin is a "wallet" – the product or application you use to get and to spend your coins – and a few coins to put in it. It truly is that straightforward.

To take in more about the distinctive wallet choices that are accessible please investigate our article: Bitcoin Wallets Explained.

There are a wide range of spots you can go to purchase coins, contingent upon where you are on the planet and how you need to pay. One prominent site which offers distributed exchanging and can along these lines be utilized as a part of most nations and with most installment strategies is localbitcoins.com. For usability you may likewise get a kick out of the chance to consider across the board benefits like Coinbase, which give an approach to you to purchase coins and a wallet to store and spend them from.

You can likewise get a little sum for nothing, just to attempt everything out before you make that dedication and purchase your first Bitcoin, from a faucet site.

No comments:

Post a Comment